The Key to Success: An Immersive Experience

The "Big Brother" phenomenon as an indicator of the experience that users choose to go through.The entire industry has been asking what’s behind the television success of “Big Brother” in Argentina, a program that has reached rating peaks of 20.18 points while the average in Argentina for the same time slot was 6 points. The question gains emphasis in the particular context where this success happens: the debate about the future of linear TV in the face of the immense variety of streaming content and multiple digital offers when it comes to entertainment.

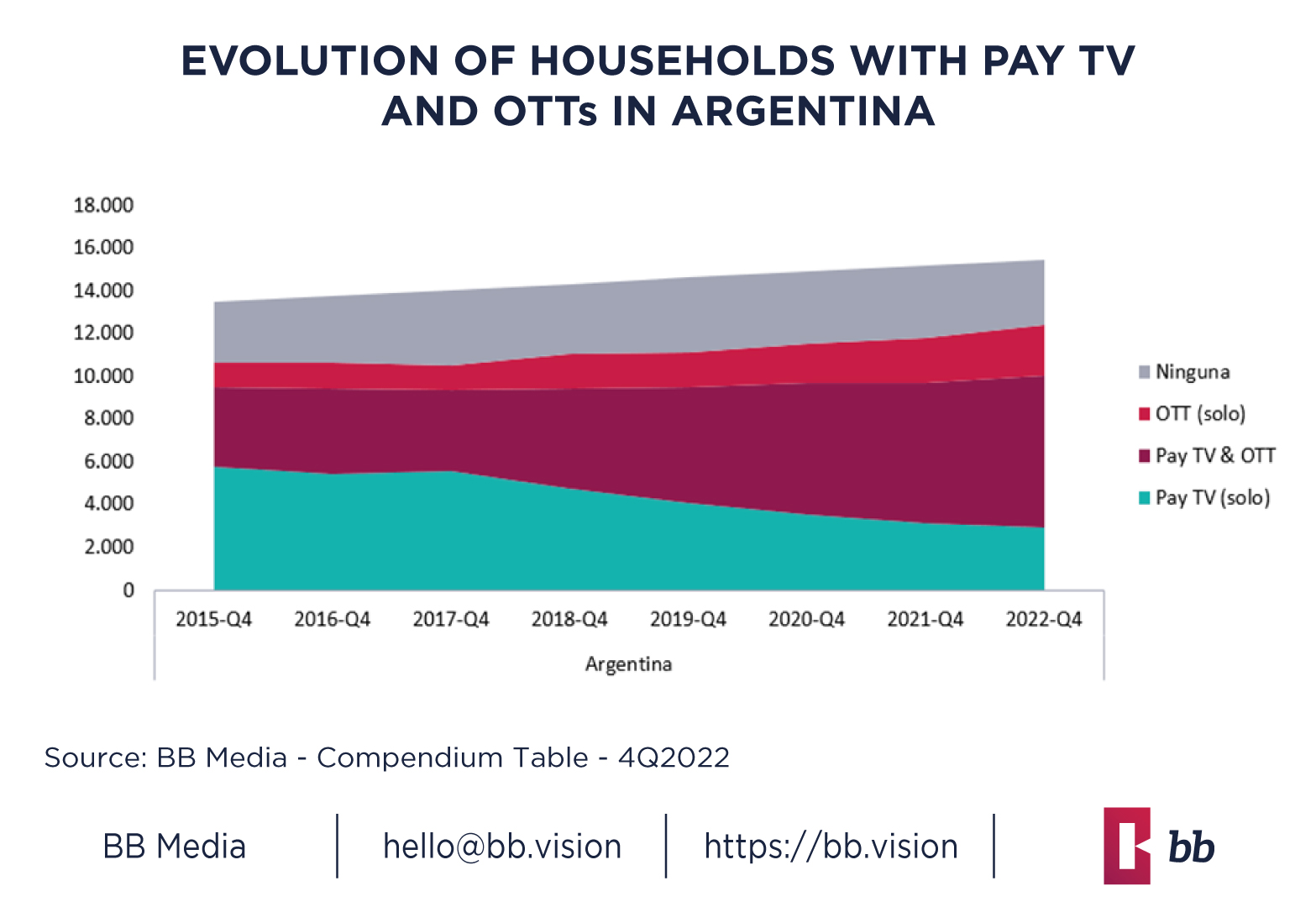

According to data from BB Media, those who choose to unsubscribe from Pay TV do so mainly due to price (47%), lack of use (30%), and the possibility of seeing similar content on the internet for free (24%), among other things. Despite this phenomenon, as seen in the chart below, while the portion that only subscribes to Pay TV decreases, the portion that subscribes to both Pay TV and streaming platforms increases at an even greater rate.

This migration of user preferences towards hybrid consumption has been timely recognized by TV industry leaders, who have established alliances with streaming platforms in recent years to cope with the situation. They have facilitated user access to these platforms, provided them at no additional cost, or offered them at a promotional price. Some TV companies have also created their own platforms in order to capture the new audiences that prefer On-demand content. Upon analyzing the main players in the country, all of them offer agreements with some OTT, and only one of them does not have its own OTT.

However, the current dynamism is also presenting limits to this industry. Analyzing the reasons for the main platforms’ cancellations, it can be found that among them are the cost (35%), lack of time (14%), or having finished watching the series for which they initially subscribed (12%), among others. Furthermore, a somewhat disloyal audience can be encountered, as the average time of those who decided to unsubscribe does not exceed 3 months, with Netflix being an exceptional case, as the majority declares having been subscribed for more than a year.

Today, the market has an extensive and varied offer of content that finds its limit in the daily hours that people have for entertainment and the money they can allocate to this activity. Argentines allocate 18 hours weekly (+3.5 hours vs LATAM) and 19% of their monthly salary to entertainment (-3% vs LATAM). The key point is that within these parameters, the universe of possibilities is extensive.

The difference between this new challenge and the challenges that Pay TV was facing with the birth of its great competitor, On-demand content, is that today’s context is more diverse and dynamic, allowing companies from both industries to have greater leeway in navigating it. This can refer to a context led by the simultaneity of activities and the simultaneity of screens.

More than half of users who consume video platforms and Pay TV express that they do some other activity while watching content. The average is up to two additional activities simultaneously, and the most mentioned is doing household chores.

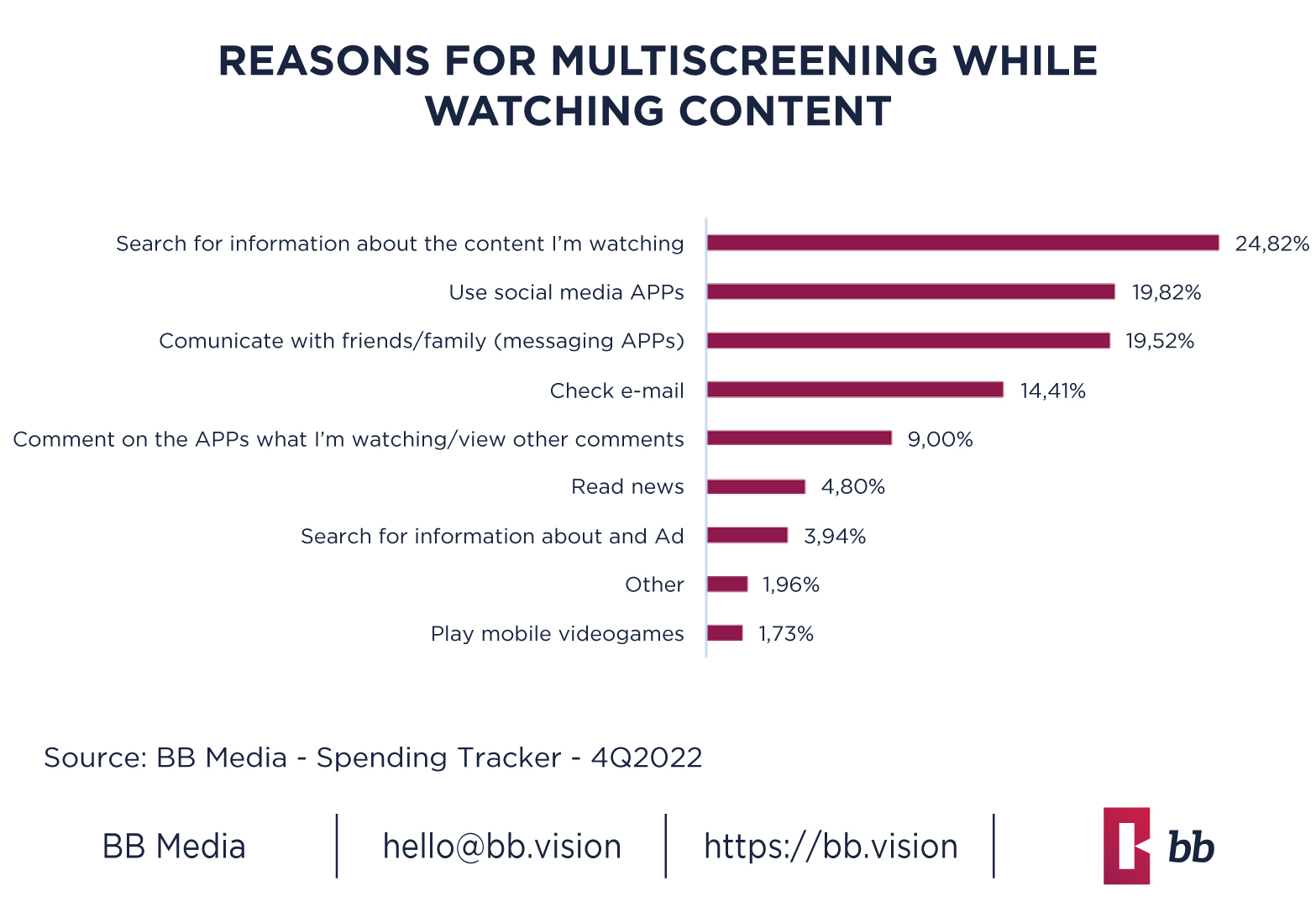

But that’s not all. It’s not enough for them to do more than one activity simultaneously; they also require the simultaneous use of devices, known as “multiscreening.” More than one-third of Argentines use an additional screen to the main screen from which they are watching linear/On-demand content, either to look up information about what they are watching, to comment on social media about the content itself, or for any of the other reasons detailed in the chart below. Watching content has ceased to be an individual or household practice and has become a means that allows interaction with other users, thanks to the connection between services and screens. They no longer want to consume content alone; they need to know in real-time what other users are thinking or sharing about that content.

What users are demanding is nothing more than an experience similar to what the metaverse can provide: a comprehensive experience that involves them and proposes new ways of socializing from miles away. There is no single space to navigate content but many spaces that converge to form a new ecosystem that “makes them a part of it.”

The format of the latest version of “Big Brother” shows an analysis of this situation and the implementation of a program that reflects the demands of today’s users: the creation of additional content, 24-hour live streaming on streaming platforms, live broadcasts on Instagram simultaneous with the transmission of the program, special editions via Twitch, and surveys on social media. This creates a universe of screens and possibilities for interaction that make the content much more than just the content.

Consumer preferences will be the ones shaping the next advances in the entertainment industry. Today’s generations have everything at their fingertips and the prevalence of TV, as well as streaming platforms, lies in knowing how to integrate everything into an attractive offer that, in turn, integrates users with each other. In this sense, the inclusion of the concept offered by the metaverse appears to be key for the industry.

WRITTEN BY: Camila Rojel (AUDITV+ & Spending Tracker Project Leader)

ABOUT BB MEDIA

BB Media is a global Data Science company, specializing in Media and Entertainment for over 35 years. BB Media monitors +4,500 streaming services in +250 countries and territories, their prices, plans, packages and commercial offers. In addition, all film and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content APPs and technology companies rely on BB Media’s information and value-added analysis to make strategic decisions.

BB Media has offices in USA, Argentina, Brazil, Mexico, Colombia, Ecuador, Italy and the Netherlands.

Source:

AUDITV 2015 4Q & 2022 4Q

Spending Tracker 2022 4Q

New Media Essentials 2022 4Q

Ratings October 22´- March 23´

MPO 2022 4Q

CONTACT US