Amazon Prime Video Launches the Ads Plan, is the UK the perfect fit?

A comparison between Amazon and Netflix, when they launched the ASVOD plan in UKAmazon Prime Video has just launched its first ASVOD (Ad-Supported Subscription Video on Demand) plan in the UK, currently offering monthly and yearly subscriptions priced at £8.99 and £95 each. This new business strategy includes ads in all its current subscription plans and offers subscribers an ad-free experience for an additional cost of £2.99 monthly. But what makes the United Kingdom one of the best suitors for Amazon Prime Video to try out its ASVOD model for the first time in Europe?

According to BB Media’s data, AVOD‘s (Advertising Video on Demand) penetration among British users has been steadily growing. From 68% in the second quarter of 2022, it reached a peak of 73% one year later, leaving SVOD behind at 70%.

The UK presents a preference for the AVOD plan, especially strong among younger age groups (16–34-year-olds). Gen Z are the ones who take the lead, with a notable 89% using this revenue model. Additionally, the penetration of FAST (Free Ad-Supported Streaming Television) has reached 26%. All this seems to indicate a notable shift in consumer preferences, with the UK moving from costly subscription plans to more budget-friendly streaming experiences that include ads.

This trend becomes evident when considering how British streaming users prefer to access online content. In the fourth quarter of 2023, almost 4 in every 10 users were inclined towards having free access with ads, while almost 3 in every 10 users liked best having free access with ads and an additional payment to remove them. Moreover, when asked about adding commercial ads to their subscription plan to lower its cost, 69% of users expressed an affinity for a more affordable plan, even if that meant having commercials interrupting the content.

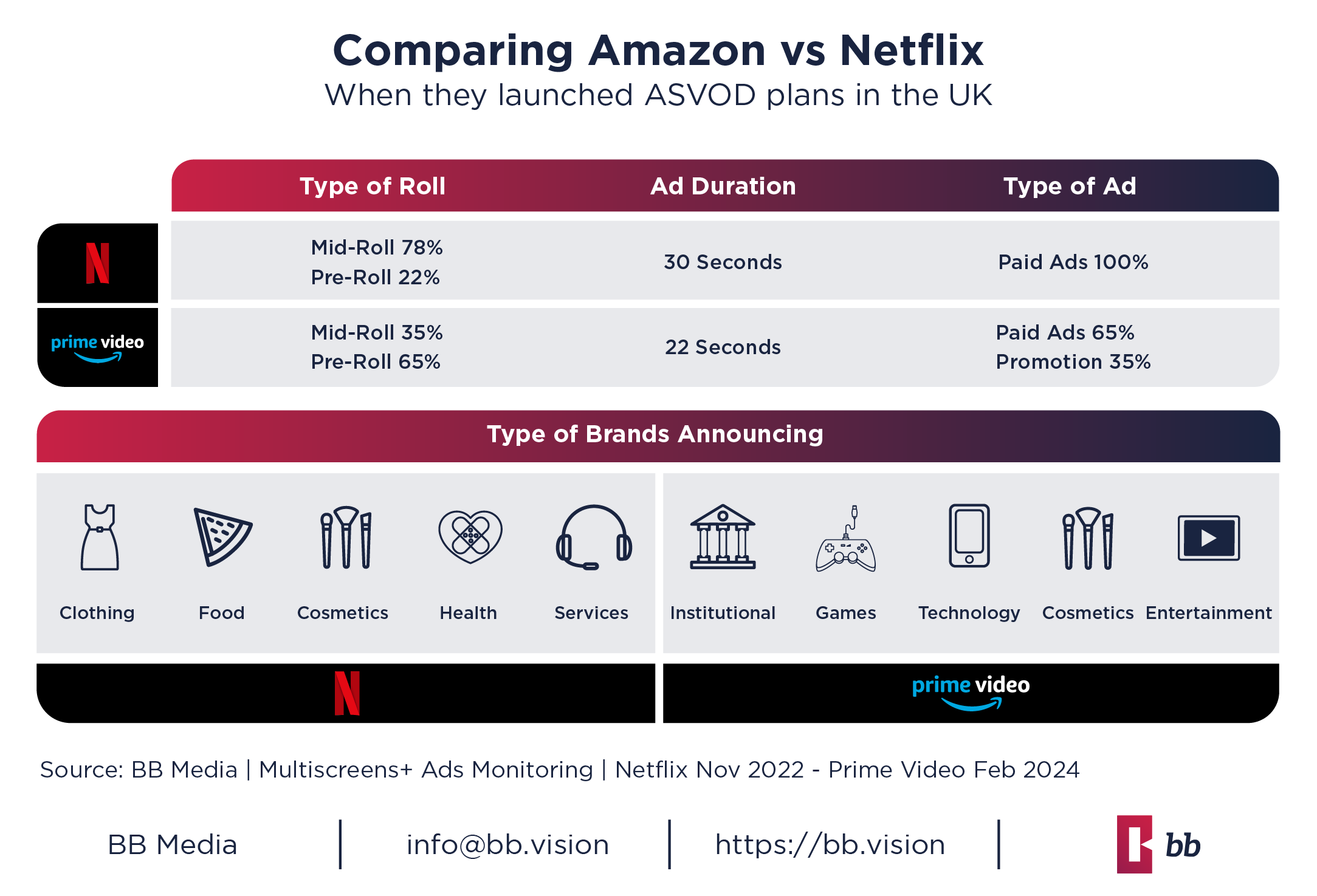

Following in the footsteps of Netflix and Discovery+, which introduced their ASVOD plans in the UK in 2022, Amazon Prime Video is making a similar move. In the realm of ads, BB Media has analyzed the initial ads on Prime Video’s content, anticipating potential adjustments to enhance user experience.

Notably, the number of ads added was limited, leaving gaps in coverage for categories such as kids or sports. Most rolls featured a single advertising insertion, offering no option to skip the ads. Amazon showcased not only paid ads from various brands but also promotions sponsoring its Ad-Free plan and Amazon Red Nose Day. Furthermore, most insertions are under 30 seconds, and mid-rolls typically appear within the initial 20 minutes of the content.

In comparison, Netflix has incorporated mid-roll and pre-roll insertions into some content, with the option also to skip advertising videos. The streaming giant recently announced a strategic shift, phasing out its most affordable ad-free plan starting in the second quarter of 2024. Subscribers will have to choose between the pricier ad-free package (£11 per month) or the more economical ad-supported plan (£5 per month). Netflix’s experience launching its first ASVOD plan in the UK yielded notable results, with 10% of its consumer base subscribing to its ad-supported plan during the second quarter of 2023. Results from the fourth quarter indicate a growing trend, with Netflix now having 12% of its consumer base subscribed to its ASVOD plan.

Despite the already high penetration of Amazon Prime Video in the UK, which stood at 70% during 2023, it remains to be seen whether the introduction of an ad-included offer will further increase its subscriber base. Based on the analysis of British users’ consumer preferences, BB Media’s insights suggest positive prospects for Amazon Prime Video’s future in the market.

ABOUT BB MEDIA

BB Media is a global Data Science company, specializing in Media and Entertainment for over 36 years. BB Media monitors +4,500 streaming services in +250 countries and territories, their prices, plans, packages and commercial offers. In addition, all film and series catalogues, including standard metadata. Streaming services, networks, programmers, cable operators, agencies, advertisers, studios, distributors, content APPs and technology companies rely on BB Media’s information and value-added analysis to make strategic decisions.

BB Media has offices in USA, Argentina, Brazil, Mexico, Colombia, Ecuador, Italy and the Netherlands.

Sources

BB Media – Multiscreens+ | Ads Monitoring – Netflix Nov 2022 – Prime Video Feb 2024

GET IN TOUCH WITH US